Retirement Options

1. THE CHOICE IS YOURS

Your life after work is ultimately what your membership of the pension scheme is all about. If you are planning to retire in the next few years, it is time to start thinking how your hard-earned pension savings can start paying you back.

You have several options open to you in respect of what to do with the money in your pension account. The choice is yours to make, but remember the money you have accumulated may literally have to last a lifetime — not just yours, but potentially anyone else who might be dependent upon you as well. This booklet is therefore designed to help you understand the options you have and some of the things you need to think about.

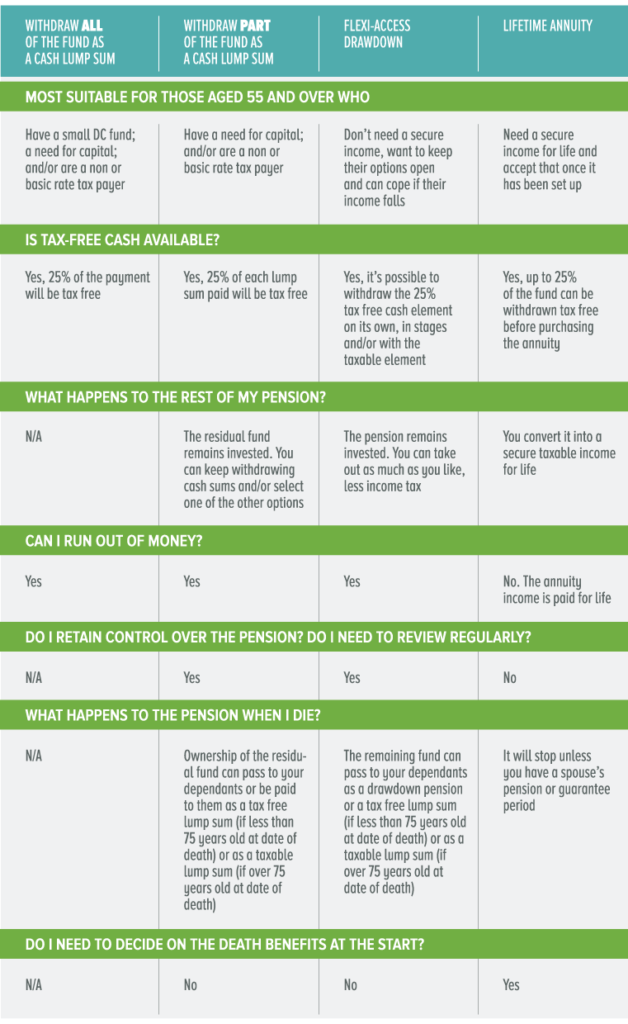

2. YOUR CHOICES IN SUMMARY

3. DECISIONS, DECISIONS… HOW DO YOU MAKE THE RIGHT CHOICE?

Hopefully you now understand the different options a little better, but how do you decide what is right for you?

It’s important to consider how the different options work and what their implications are before making a decision.

The most typical implications of each choice available are detailed below.

Leave your retirement savings where they are and do nothing

The qualifying criteria are:

- Your retirement savings can remain invested until you need them.

- Allows you to decide when you take your retirement savings.

What you should consider if you are thinking about this option:

- Are your retirement savings invested in the right kind of investments for your objectives or should you choose to invest your retirement savings differently? (For example, moving out of a default investment strategy.)

Leave your retirement savings invested but take

an income from them (flexi-access drawdown)

What this involves:

- You can leave your retirement savings invested but choose to take a regular income from them.

What you should consider if you are thinking about this option:

- Twenty-five percent of your savings can be taken as a tax-free lump sum, but you’ll have to pay tax on any income you take over and above this at your marginal rate.

- There are no maximum or minimum limits on the income you can take. But you need to make sure you don’t deplete your savings too quickly, otherwise, you might have to reduce your income in the future and you might even run out of money.

- Deciding how much income to take can be complicated and needs to take into account how long you might live for, the investment performance of the funds in which your retirement money is invested, and whether or not you might want to leave behind a percentage or your entire

- You should consider the frequency at which you want to receive payments, be it annually, quarterly or monthly, and the impact of any associated charges.

Take all or part of your money out of

your retirement savings as a cash lump sum

What this involves:

- You give an annuity provider (usually an insurance company) the portion of your retirement savings you decide to allocate to the annuity. In return, they pay you a guaranteed income for the rest of your life.

What you should consider if you are thinking about this option:

- The tax implications of withdrawing cash can be significant. Depending on how much you take from your savings, and other income you might be receiving at the time, you could end up paying a lot of income tax.

- Think carefully about what you do with the money you withdraw as you could run the risk of running out of money at some point during retirement.

Guarantee your income by buying an annuity

What this involves:

- You give an annuity provider (usually an insurance company) the portion of your retirement savings you decide to allocate to the annuity. In return, they pay you a guaranteed income for the rest of your life.

What you should consider if you are thinking about this option:

- Once you’ve purchased your annuity, your rate will normally be fixed

- How much income you can get from an annuity depends on a variety of factors, including age, health and whether you want the income to pass to someone when you die.

A combination of 2, 3 and 4

What this involves:

- You can choose to combine the different options giving you the flexibility to make sure your retirement savings meet your objectives.

What you should consider if you are thinking about this option:

- Different combinations will have different implications, particularly in regard to the amount of tax you might have to pay. Speaking to an adviser or someone at Pension Wise will help you put these implications into context.

- Details of how to contact Pension Wise are provided in Section 6 – Contact details.

4. BUDGETING FOR RETIREMENT

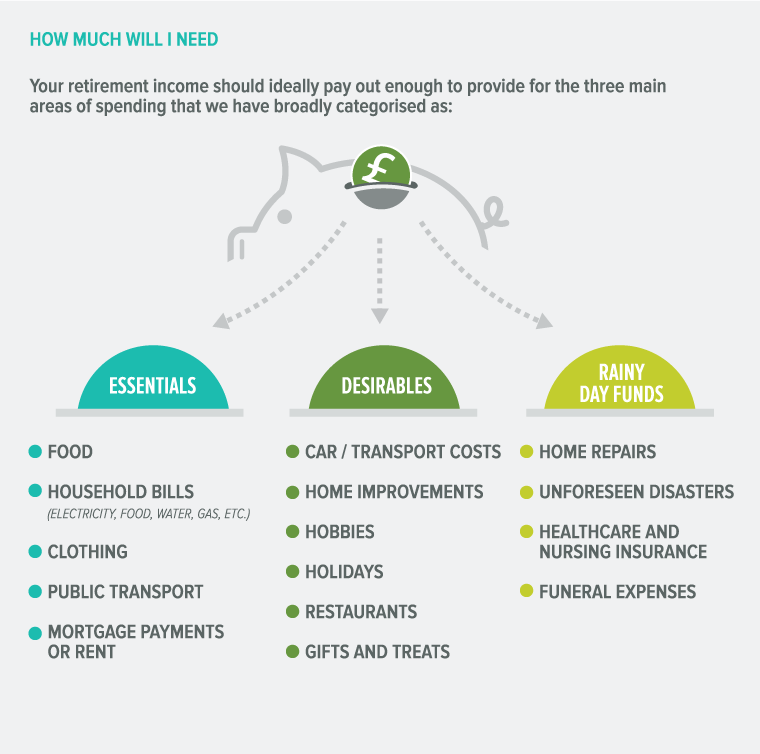

If you are relying on your pension fund to provide you with a retirement income, you need to work out how much you will need. This may also help you decide how to use your pension account and whether you need to save more before stopping work entirely.

As you approach retirement, you should start to budget for each of these categories in order to come up with an estimate of how much income you will need in retirement. Your primary focus needs to ensure that you can meet your essential expenditure, but clearly your goal will be to fully or partially meet your desirables and rainy day funds.

You should also note that your income requirements may change as you grow older. For example, more money may need to be allocated towards nursing and healthcare in your later years, whilst your active participation in certain hobbies might reduce as you get older.

Essentials spending could account for around 30% to 40% of your preretirement salary and desirables for another 10% to 20%. Your rainy day funds can potentially be funded by either your tax-free cash and/or other savings in nonpension-related investments, but again you will need to consider this in advance and plan accordingly.

Once you have decided upon your target retirement income, you should compare this total with the projected benefits from your personal, occupational and state pensions to see if your essential needs in retirement will be covered.

The Pension Planner tool available on your member website will give you some guidance as to how much you can expect to receive in income from your pension scheme as well as how much more you can expect to receive from increasing your contributions or retiring later.

If your projected benefits are insufficient to provide you with the income you desire, you may need to consider some or all of the following to close the gap.

Increase your contributions:

You may consider increasing your personal contributions. You may also be eligible for additional matching contributions from your employer.

Alter your investment strategy:

If you are invested in cautious funds, such as fixed income or cash funds, you have the option of opting into a more aggressive investment option that may provide a higher return on your investment. (Please note that higher risk options also have a greater chance of losing value especially over short periods of time.)

Consider retiring later:

You can keep your pension account invested for longer, giving your monies longer to grow. Plus, for those considering purchasing an annuity, the cost of buying an annuity can improve the older you get.

Lower your income expectations:

It may be necessary to cut back on some of the desirables that you may currently take for granted when you are in work to ensure that you can maintain a stable income. This may also involve downsizing your house, going on fewer holidays or taking other cost-saving measures.

5. WHAT HAPPENS NEXT?

Retirement still a distant dream or just around the corner? As you get nearer to retirement, there are a number of things you should consider.

What’s your stage?

1. Planning on working beyond your selected retirement date or retiring early?

You should inform the Scheme Administrator as soon as possible, particularly if you are in a default lifestyle investment strategy, as this will allow the administrator to adjust both your selected retirement date and your investments if appropriate.

2. Ten years or more to retirement?

Check if you will have enough income to retire. Your annual benefit statement shows the level of pension you might receive at your selected retirement date and should be considered alongside any other pensions or savings that you might have. Use the pension planner tool and consider increasing your payments if you haven’t saved enough.

3. Between four and nine years to retirement?

If you are in a Lifestyle Profile, then your retirement account may have already started to de-risk. This may mean your money will be moved from riskier investments, such as stocks and shares, into less risky investments.

4. Around six months before your selected retirement date?

We will write to you six months before your target retirement date to remind you of all of your retirement options listed in Section 2. We’ll also provide you with some indicative quotes that show the kind of income you might receive, were you to purchase an annuity at your target retirement age.

5. Over 55 and looking to take some of your benefits?

If you are aged 55 or over, have considered your choices, and would like to exercise one or more of the retirement options detailed in this booklet, please contact the Scheme Administrator. We will send you the paperwork you need to get things started.

Remember, we have attempted to cover the most likely options and typical implications of each choice available in this booklet, but there may be others that apply to you that we haven’t covered here. We recommend anyone considering taking benefits from their pension account to contact the Pension Wise service in the first instance.

Pension Wise is the government’s free and impartial service to help people understand what their choices are.

See Section 6 – Contact details.

6. CONTACT DETAILS

Please contact the Scheme Administrator, SEI Trustees Limited, for specific queries relating to your membership of the Scheme or your benefit entitlement:

SEI Trustees Limited

SEI Trustees Limited

c/o Capita Employee Benefits

PO BOX 555

Stead House

Darlington

DL1 9YT

Tel: 0800 011 3540 or 0114 273 7331

Fax: 0114 241 4107

Email: seic@capita.co.uk

When contacting SEI Trustees Limited, you will be required to validate your identity. If writing or emailing, you should clearly state your name and National Insurance number on any correspondence.

Please note that the administrator can only provide you with information about your pension account. They cannot give you advice or comment on any other pensions you may have.

Additional contact details for organisations who may be able to provide further assistance to you as a Scheme member are listed in your ‘What, Where, How and Why?’ booklet, which also gives details of the standard Scheme and benefit information that you are entitled to receive.

The Money and Pensions Service

Set up by Government, the Money and Pensions service brings together Pension wise, The Pensions Advisory Service and the Money Advice Service. This means that if you need free and impartial pensions guidance or would like to access a range of modelling tools you can do so in one place.

https://moneyandpensionsservice.org.uk

For general enquiries, please contact:

contact@singlefinancialguidancebody.org.uk

Phone: 01159 659570

Remember, nothing in this guide should be considered as advice. If you require advice the trustee recommends you contact an independent financial adviser.