Risk Factors

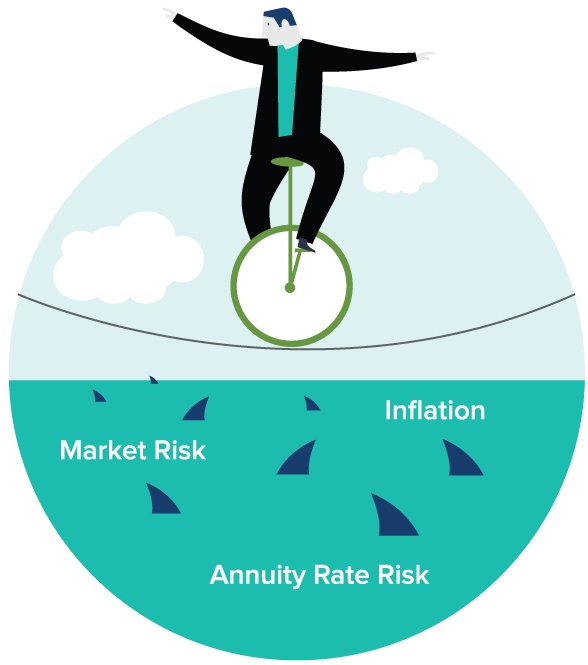

The concept of risk is one of the realities of investment

— and one that is important to understand.

It’s common that a person’s first real experience in dealing with the financial markets is when they start investing for retirement. And it’s also their first encounter with the risks that go along with this action. This is why many anxious investors choose conservative — lower risk, lower return — vehicles for their money.

However, being too conservative may hinder you as you strive to accumulate the wealth you’ll need to retire comfortably. Understanding risk and knowing you’re in it for the long haul will help ease your worry if the financial markets are occasionally causing your savings to drop in value. Four of the most common types of risk when it comes to retirement investment are:

Market Risk

Market risk is the chance that the return on your investment will be less than what you expected, and that the value of your investments could decrease, due to changes in the financial markets – usually the stock markets.

Inflation Risk

Inflation drives up the cost of what we spend our money on. In other words, it reduces the buying power of your savings. As your retirement savings build up, you must be mindful of the spending power of those savings in later years. One of the risks that you face later is not having saved aggressively enough to overcome the bite inflation takes out of every pound you earn and have saved. For instance, if you manage to get a return of 4% p.a. on your investment but inflation averages 5% p.a. over the same period, you would actually be worse off because your savings have not grown to match price increases.

Annuity Rate Risk

Annuity rates govern the cost of turning your savings into an annuity (or pension) when you retire. These rates tend to vary with factors such as economic conditions and life expectancy, and there is a risk that, if the rates are unfavourable when you come to retire, buying a pension could be more expensive than you had anticipated. It therefore makes sense to try to ensure that, even if the rates aren’t great at the time of your retirement, you still have enough money saved to achieve sufficient income in retirement.

Longevity Risk

Longevity risk is basically the risk that you might live longer than expected. This is obviously a good thing, but can cause you financial problems if you haven’t budgeted for it.

If you purchase an annuity at retirement, then your income is paid ‘for life’ – whether you live for five years or fifty. This means that the longevity risk sits with the life assurance company that you bought your annuity from. If you are taking an income directly from your pension account (known as drawdown) then as well as considering the level of income and the timing of withdrawals, you must also think about how long you might live for.

Your savings in the scheme are likely to be affected by all of these risks and you should bear them in mind when making investment decisions – remembering that it is impossible to avoid risk altogether.