Asset Classes

Having thought about the various risks your investment may be exposed to, you next need to become familiar with the major types of investment, or asset classes.

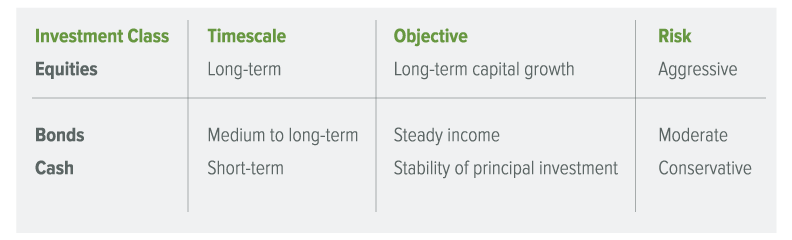

Broadly speaking, there are three main types of investment available to you in the scheme: equities (or stocks and shares), bonds (or fixed income investments) and cash. Each investment will return different rewards and each has distinct levels of risk. You have a diverse set of investments to choose from in your scheme. Each of these investments will fall under one of the major classes – some may be a combination of two or three. Please refer to the fund information in your fund factsheets for more details.

Equities

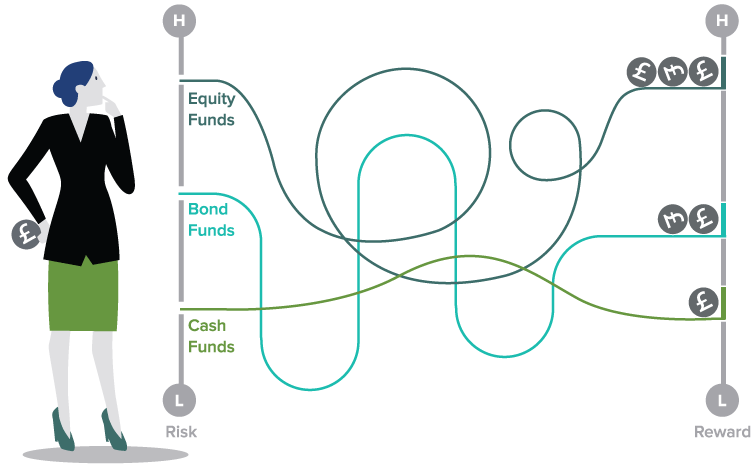

Equity investments (or stocks) represent ownership in a company. They give your savings the opportunity to earn dividends (your share of the company’s profits) and to grow through capital appreciation (the increase in value of your shares). As the charts below on the following page indicate, over the long-term, equities have, at times, had greater returns than other asset classes. However, they also carry greater risk than other investments, making them generally more suitable for long-term investment and for moderate to aggressive investors.

Bonds

Bonds, sometimes called fixed-income investments, represent a loan to a corporation or government. They are used to raise money to finance a project or business opportunity. The corporation or government promises to pay interest to the investor, usually at a fixed rate for a given period of time.

The level of risk involved will normally depend on the stability of the organisation taking the loan. Gilts, for example, are loans to the UK government and are considered to be one of the most secure bond investments, although their value can still go down as well as up. The more risky the loan (bond), the more the interest payment you’ll receive, meaning that, as with other investments, the greater the risk, the greater potential for reward.

Bonds are generally more stable than equities, as they are less vulnerable to stock market fluctuations. Bonds are seen to be a better match for annuity rates pre- retirement. They therefore generally represent a good mediumterm investment for moderate or conservative investors or those looking to purchase an annuity.

Cash Funds

Cash funds are sometimes called money market investments. They are considered low risk and usually gain low returns on the principal (the amount of money originally invested). If you concentrate a large portion of your retirement account in investments that fall into this asset class, the growth of your portfolio may not outpace inflation. This means you may fall short of your retirement savings goal. Cash funds can, however, represent a safe short-term home for your savings in the time immediately prior to your retirement, when you may want to protect the savings you have built up from any sudden falls in the stock market.

Asset Class Summary

Your Investment Options

Your scheme may offer a choice of many different funds where you can build your own investment strategy. Like the asset classes, each fund offered provides distinct risks and rewards.

Depending on the fund’s objective or style, the companies may have one or several characteristics in common. When you invest in a stock fund, you buy a percentage of several companies’ shares. The value of your fund may fluctuate because of what is happening within the companies that make up the fund, as well as economic trends, industry factors, the financial condition of one or more of the companies and consumer and analyst favouritism.

The investment funds available in your scheme will in themselves provide some level of diversity. You can think of an investment fund as many similar securities pooled into one investment vehicle. Your money is considered diversified because you are not buying one bond or one stock.

Each fund has a specific style of investing and a primary objective. One fund’s aim may be to protect your capital investment; another may aim to increase your money by generating income or through aggressive long-term growth.

Please remember that past performance of investments is no guarantee of their future performance.