Asset Allocation

Asset allocation is the final piece in the investment jigsaw

—and it’s a very important one.

New investors, at times, tend to be overly conservative with their investment choices. By limiting your investments to only the most conservative choices, you could compromise your ability to live the lifestyle you would like during retirement. And that is the reason why asset allocation is so important.

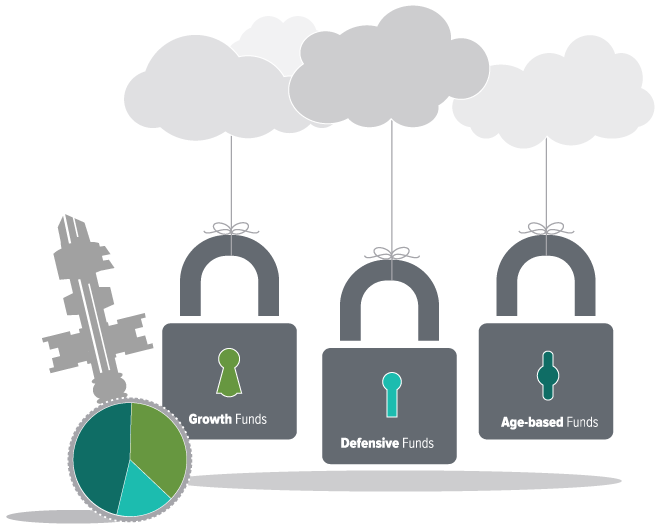

Essentially, your asset allocation is how you choose to spread your pension savings across the various funds and asset classes available, investing in accordance with your goals and your attitude to risk. This will be the key to managing that all-important balance between risk and reward.

Asset allocation works by ensuring you own different categories of investments, so when some of the investments are down, others may be up. The result is an investment portfolio that has the potential to experience less fluctuation in value than the individual assets within each fund. For instance, if you have a portion of your savings in bonds as well as equities, your portfolio may not be dramatically affected if the stock market experiences a drop in value.

The variety of investment funds available in this scheme range from conservative to aggressive. And each one will fuel your pension portfolio at a different rate. Study all of them carefully. Remember, the mix you choose has a significant impact on the growth of your savings. Studies show that asset allocation decisions alone explain the majority of a portfolio’s long-term performance – making the type of investment much more important than the performance of any individual equity or bond fund.

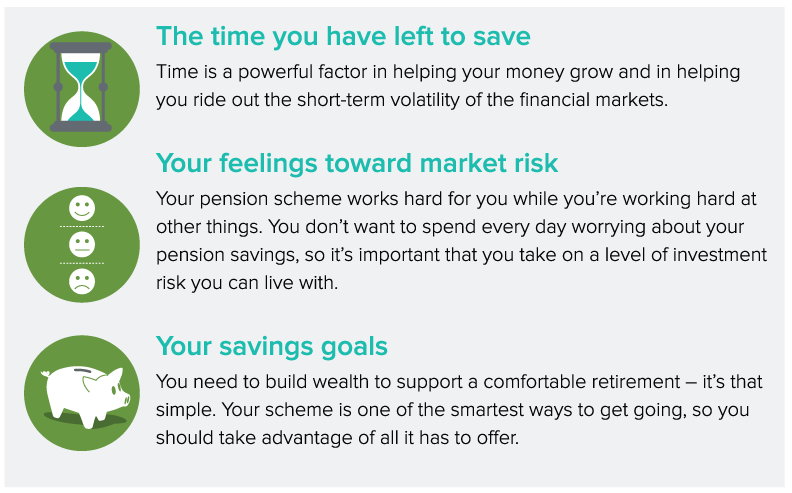

Your asset allocation strategy should have one overriding characteristic – you. Keep the following factors in mind as you select the funds that will make up your pension portfolio.

Remember that you’re investing for a long term goal – your retirement. Exposing your savings to some risk in exchange for the potential to earn higher returns may be an appropriate strategy, especially if you still have years to go before your retirement begins. As you move closer to your anticipated retirement date, you may decide to adopt a more conservative strategy designed to protect the gains you’ve earned over the years.

Asking yourself these questions will also help you to determine the type of investor you are:

Are you a conservative investor, inclined to head for safety and therefore invest a large percentage of your retirement savings in bonds instead of equities? Or are you an aggressive investor, willing to take some risk over the long-term and comfortable investing a large portion in equities? Or might you be somewhere in the middle and therefore class yourself as a moderate investor?

Wherever you are today, your attitude towards risk is likely to change over the years, so you should revisit your asset allocation regularly.

When determining your investment strategy, ask yourself the following questions:

If an investment loses money over the course of a year, can I resist the temptation to sell, keeping in mind I’m investing for the long term?

Do I need investment stability or am I willing to accept frequent fluctuations in my account balance?

Do I have a long timescale before needing this money for retirement or will I need it within the next 5 years?